It is very safe, is home to many employees, and has an emphasis on sustainability and the arts.

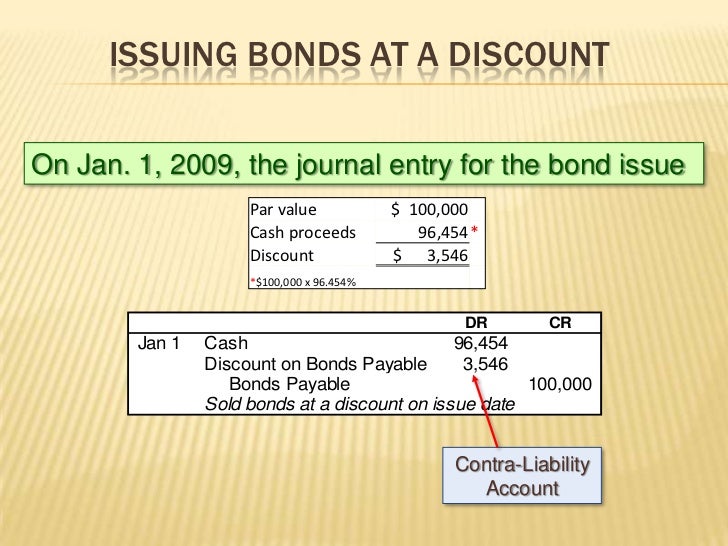

Clean Up of Accounting Records

If more of your time is being spent managing your accounting chores than managing your https://www.bookstime.com/ business, we are here to help. With a team of great community accountants, Delozier Accounting is here to take this away your burden allowing you to focus entirely on the real issues for your business growth. While many payroll companies offer a take-it-or-leave-it, cookie cutter approach, we at Delozier Accounting custom tailor our services to meet the needs of each individual client.

How far is Hillsboro from the coast?

Hillsboro, Oregon, is a thriving city nestled in the heart of the picturesque Tualatin Valley. With a unique blend of technological innovation and natural beauty, Hillsboro offers a dynamic and welcoming community. The city’s commitment to sustainability, top-notch education, and a strong sense of community make it a delightful place to call home. Whether you’re exploring its charming downtown, enjoying its beautiful parks, or engaging in its rich cultural experiences, Hillsboro offers a perfect blend of modernity and nature in the heart of Oregon’s Willamette Valley.

Nicki Rind Consulting

- Rest assured, you can rely on us to provide precise and highly efficient bookkeeping services that not only align with your expectations but also comfortably accommodate your budget.

- We are ready and able to serve as your financial advisor, tax planner, and guide along your path to success.

- We also offer a host of specialty services to cater to the unique needs of our community clients.

- State Comptroller Keith Regan (formerly of Maui) leads DAGS, which is responsible for managing and supervising a wide range of state programs and activities.

- Our commitment extends beyond the numbers, helping you navigate and comprehend the specific bookkeeping and accounting services that align with the distinct needs and goals of your Hillsboro business.

At All About Businesses, our core mission revolves around harmonizing our services with your individual requirements and circumstances, because gaining financial assistance should be a hassle-free journey. Reach out today for a free consultation and an accounting and bookkeeping solution that is right for you. Our firm in Hillsboro provides expert preparation of federal and state estate, gift, and trust tax returns. We strive to build strong and lasting business relationships with each of our clients. Browse petty cash our Website to see the services we offer and helpful resources we provide. The state Department of Accounting and General Services (DAGS) has hired its first Communications Officer.

- Let our accounting professionals negotiate on your behalf and put an end to your IRS worries.

- We understand that every business is unique, so we take a customer-centric approach to our services, providing you with the financial flexibility you need to succeed.

- Regardless of whether you’re a new business owner or an established one, we’re here to streamline your financial management.

- We provide small businesses, entrepreneurs, startups and individuals with full-service bookkeeping and accounting services.

- The city’s commitment to sustainability, top-notch education, and a strong sense of community make it a delightful place to call home.

- Bob M. Keller, CPA provides unparalleled personalized accounting services to a broad range of clients across the Hillsboro area.

- It is very safe, is home to many employees, and has an emphasis on sustainability and the arts.

- This certification ensures that we consistently use the latest advancements in bookkeeping techniques.

- As a small business advocate, Nicki specializes in tax preparation and bookkeeping, while focusing on the unique needs and goals of your business.

- In Hillsboro, Oregon, local businesses thrive among the diverse range of restaurants, farms, entertainment, and outdoor spaces.

- With a proven track record in IRS debt solution, the team at Delozier Accounting is here to help you.

We serve a wide range of individuals, corporations, partnerships, and non-profit organizations and are experts in the accounting issues and tax laws that impact our clients. In Hillsboro, Oregon, local businesses thrive among the diverse range of restaurants, farms, entertainment, and outdoor spaces. As a small business owner in the area, your priority is to connect with your customers and grow your company, not spend hours managing financial records. We are a trusted team of local bookkeepers who specialize in handling all your business’s bookkeeping and accounting needs. From maintaining organized records to providing financial advice and making tax season less stressful, we’re here to help. Our experienced team has worked with a variety of businesses in Hillsboro and beyond, including non-profits, restaurants, retail stores, and real estate agents.

As a small business advocate, Nicki specializes in tax preparation and bookkeeping, while focusing on the unique needs and goals of your business. She looks to simplify real time accounting processes, increase tax understanding, and keeps your bottom line in mind every step of the way. We provide small businesses, entrepreneurs, startups and individuals with full-service bookkeeping and accounting services. Our Hillsboro area accountants and tax professionals have a high level of expertise to improve your accounting practices. Whether you are looking for personal or corporate tax aid, planning or preparation, Delozier Accounting offers a full compliment of tax services, tailored to the individual needs of our clients.

We will provide Personal and Business bookkeeping that will keep your records reconciled and up to date. With a proven track record in IRS debt solution, the team at Delozier Accounting is here to help you. Let our accounting professionals negotiate on your behalf and put an end to your IRS worries. We at Bob M Keller, CPA, practice a disciplined, integrated approach to corporate taxes. This business has not enabled messaging on Yelp, but you can Bookkeeping Services in Hillsboro still contact other businesses like them. Hillsboro has been consistently rated one of the top places to live in the United States.